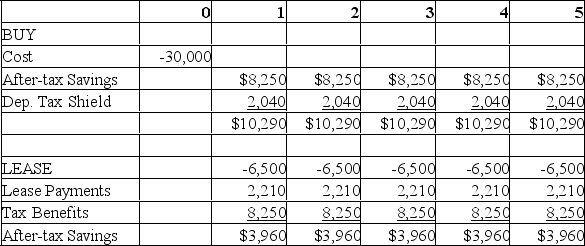

The Blank Button Company is considering the purchase of a new machine for $30,000. The machine is expected to save the firm $13,750 per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $6,500 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 34%, and its cost of debt is 10%.

Calculate the NPV of the lease versus the purchase decision.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Your firm is considering leasing a new

Q30: Your firm is considering leasing a new

Q31: Your firm is considering leasing a new

Q32: Your firm is considering leasing a new

Q33: Your firm is considering leasing a radiographic

Q35: Your firm is considering leasing a new

Q36: Your firm is considering leasing a radiographic

Q37: Your firm is considering leasing a new

Q38: The WACC is not used in the

Q39: Your firm is considering leasing a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents