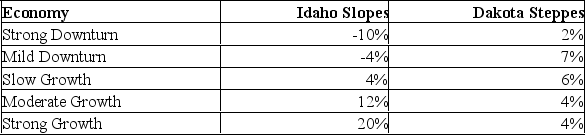

Idaho Slopes (IS) and Dakota Steppes (DS) are both seasonal businesses. IS is a downhill skiing facility, while DS is a tour company that specializes in walking tours and camping. The equally likely returns on each company over the next year is expected to be:  The variances of IS and DS are:

The variances of IS and DS are:

A) .0145; .00038.

B) .011584; .000304.

C) .006454; .000154.

D) .0008068; .000193.

Correct Answer:

Verified

Q2: A portfolio is entirely invested into Buzz's

Q3: A portfolio will usually contain:

A) only one

Q4: Stock A has an expected return of

Q5: Systematic risk is measured by:

A) the mean.

B)

Q6: Idaho Slopes (IS) and Dakota Steppes (DS)

Q8: When stocks with the same expected return

Q9: GenLabs has been a hot stock the

Q10: The rate of return on the common

Q11: You have plotted the data for two

Q12: If you have a portfolio of two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents