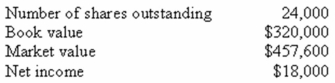

The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations.Some recent financial information for the company is shown here:  MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000, and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

MHMM is considering an investment that has the same P/E ratio as the firm.The cost of the investment is $800,000, and it will be financed with a new equity issue.What would the ROE on the investment have to be if we wanted the price after the offering to be $115 per share? Assume the PE ratio remains constant.

A) 18.28 percent

B) 21.41 percent

C) 27.63 percent

D) 37.27 percent

E) 40.03 percent

Correct Answer:

Verified

Q65: Kurt currently owns 3.4 percent of Northeastern

Q72: A.K.Stevenson wants to raise $7.5 million through

Q79: Jefferson Refining is issuing a rights offering

Q83: Mountain Homes wishes to expand its facilities.The

Q85: Atlas Corp.wants to raise $4 million via

Q86: Explain both a rights offering and the

Q87: Steve is the founder of Jefferson &

Q88: The Huff Co.has just gone public.Under a

Q91: It can be argued that the decision

Q93: Precise Machining is considering a rights offer.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents