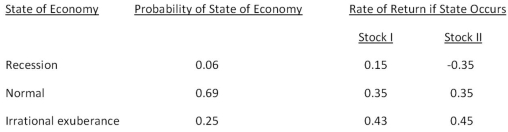

Consider the following information on Stocks I and II:  The market risk premium is 8 percent, and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent, and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

A) 2.08; 2.47

B) 2.08; 2.76

C) 3.21; 3.84

D) 4.47; 3.89

E) 4.03; 3.71

Correct Answer:

Verified

Q65: The returns on the common stock of

Q79: What is the beta of the following

Q82: What is the expected return and standard

Q84: A stock has an expected return of

Q86: Thayer Farms stock has a beta of

Q88: You have $10,000 to invest in a

Q88: Suppose you observe the following situation:

Q89: What is the expected return of an

Q108: Explain the difference between systematic and unsystematic

Q109: Explain how the slope of the security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents