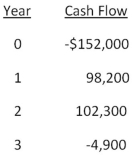

You are considering an investment with the following cash flows.If the required rate of return for this investment is 15.5 percent, should you accept the investment based solely on the internal rate of return rule? Why or why not?

A) Yes; The IRR exceeds the required return.

B) Yes; The IRR is less than the required return.

C) No; The IRR is less than the required return.

D) No; The IRR exceeds the required return.

E) You cannot apply the IRR rule in this casE.Since the cash flow direction changes twice, there are two IRRs.Thus, the IRR rule cannot be used to determine acceptance or rejection.

Correct Answer:

Verified

Q62: You are considering a project with an

Q70: It will cost $6,000 to acquire an

Q74: You would like to invest in the

Q78: Blue Water Systems is analyzing a project

Q80: An investment has the following cash flows

Q81: Colin is analyzing a project and has

Q82: Motor City Productions sells original automotive art

Q84: You are considering the following two mutually

Q88: A project has an initial cost of

Q111: You're trying to determine whether to expand

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents