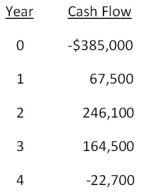

Sheakley Industries is considering expanding its current line of business and has developed the following expected cash flows for the project.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 13.4 percent? Why or why not?

A) Yes; The MIRR is 6.50 percent.

B) No; The MIRR is 8.67 percent.

C) Yes; The MIRR is 8.23 percent.

D) No; The MIRR is 6.50 percent.

E) No; The MIRR is 7.59 percent.

Correct Answer:

Verified

Q42: The final decision on which one of

Q46: Which of the following are definite indicators

Q52: In actual practice,managers frequently use the:

I.average accounting

Q58: Which two methods of project analysis are

Q60: Isaac has analyzed two mutually exclusive projects

Q62: Based on the profitability index rule, should

Q64: A project has an initial cost of

Q66: What is the profitability index for an

Q73: J&J Enterprises is considering an investment that

Q84: The Green Fiddle is considering a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents