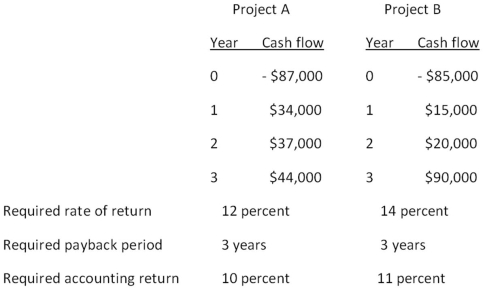

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on the average accounting return?

Should you accept or reject these projects based on the average accounting return?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on the information provideD.The AAR cannot be computed because the net income was not provided.

Correct Answer:

Verified

Q87: A project produces annual net income of

Q89: Rosa's Designer Gowns creates exquisite gowns for

Q90: An investment project provides cash flows of

Q91: You are analyzing a project and have

Q92: You are analyzing the following two mutually

Q93: You are considering the following two mutually

Q95: You are analyzing a project and have

Q96: Boston Chicken is considering two mutually exclusive

Q99: You are considering the following two mutually

Q115: An investment project costs $21,500 and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents