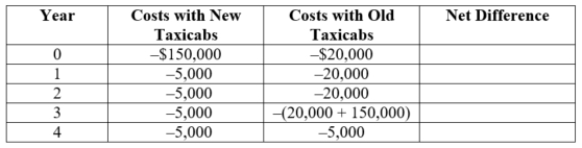

(Table: Taxi Fleet) Metro Cab is considering replacement of its fleet of old taxicabs. To replace its fleet, Metro must spend $150,000 on new taxicabs. The new taxis will incur $5,000 of maintenance expenses per year. Alternatively, Metro could spend $20,000 today to refurbish its taxicabs and incur an additional $20,000 per year of maintenance expenses for the next three years. Metro would then have to buy new taxicabs for $150,000 at the end of three years, leading to lower maintenance expenses of $5,000 per year.  Using an interest rate of 10%, the net present value of the first three years is $____.

Using an interest rate of 10%, the net present value of the first three years is $____.

A) 65,000

B) 37,272.73

C) 20,000

D) 195,000

Correct Answer:

Verified

Q72: If Chun puts $344 into his saving

Q73: If Franco deposits $1,000 today in his

Q74: Assume a future payment of $10,000.

Q75: Which of the following statements is (are)

Q76: (Table: Investments IV) Suppose that the interest

Q78: An increase in business confidence leads many

Q79: (Table: Gambling and Risk) Q80: A corporate bond has a $10,000 face Q81: Fang has the opportunity to buy an Q82: Liqin fixes up old cars and sells![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents