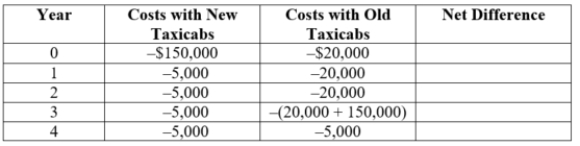

(Table: Taxi Fleet) Metro Cab is considering replacement of its fleet of old taxicabs. To replace its fleet, Metro must spend $150,000 on new taxicabs. The new taxis will incur $5,000 of maintenance expenses per year. Alternatively, Metro could spend $20,000 today to refurbish its taxicabs and incur an additional $20,000 per year of maintenance expenses for the next three years. Metro would then have to buy new taxicabs for $150,000 at the end of three years, leading to lower maintenance expenses of $5,000 per year.

a. Complete the last column of the table.

b. At an interest rate of 10%, should Metro purchase the new taxicabs today or postpone the purchase until the end of the third year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Benny was seriously injured at his place

Q93: You've won a radio contest that gives

Q94: The demand for capital is QD =

Q95: (Table: Value Analysis I) Complete the table

Q96: A company is considering extracting natural gas

Q98: (Figure: Utility and Income) Suppose that Sara

Q99: Qing and her coworkers like to bet

Q100: Suppose a real estate agent's utility function

Q101: (Figure: Utility and Income) Suppose that Sara

Q102: (Table: Payback Period) What is the payback

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents