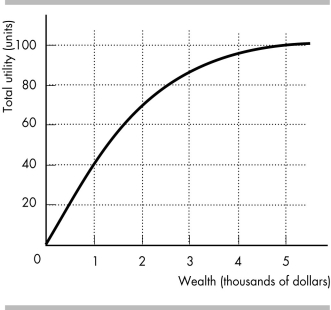

-Wendy works as a teller at a bank for a fixed salary of $1,800 per month. She is offered a job as a salesperson at which there is a 40 percent chance that she will make $5,000 a month and a 60 percent chance that she will make only $1,000 a month. The figure shows Wendy's utility of wealth curve:

a) What is Wendy's expected income from the offered job?

b) What is Wendy's expected utility from the offered job?

c) Will Wendy accept the offer? Why or why not?

d) What is the minimum fixed salary for which Wendy will continue to work for the bank and not take the sales job?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q221: A risk averse person will always buy

Q222: If reckless drivers are more likely than

Q223: A risk averse person has diminishing marginal