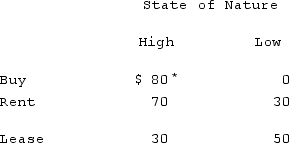

Consider the following decision scenario:

*PV for profits ($000)

If P(high) is 0.60, the choice for maximum expected value would be:

A) buy.

B) lease.

C) rent.

D) high.

E) low.

Correct Answer:

Verified

Q52: The difference between expected payoff under certainty

Q53: The term "opportunity loss" is most closely

Q54: Consider the following decision scenario: Q55: A decision tree is: Q56: The maximin approach to decision making refers Q58: Sensitivity analysis is useful because: Q59: Which one of these is not used Q60: Which phrase best describes the term "bounded Q61: Consider the following decision scenario: Q62: Consider the following decision scenario: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

A)an algebraic representation of

A)payoffs and probabilities![]()

![]()