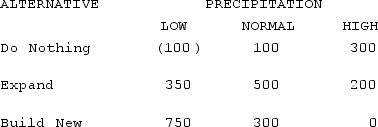

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:

If he feels the chances of low, normal, and high precipitation are 30 percent, 20 percent, and 50 percent respectively, what is his expected value of perfect information?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Q79: Consider the following decision scenario: Q80: Consider the following decision scenario: Q81: The owner of Tastee Cookies needs to Q82: The local operations manager for the Internal Q83: The local operations manager for the Internal Q85: The owner of Tastee Cookies needs to Q86: The construction manager for Acme Construction, Inc., Q87: The owner of Tastee Cookies needs to Q88: The owner of Tastee Cookies needs to Q89: The local operations manager for the Internal![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents