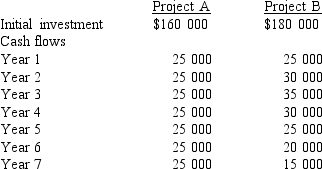

Ridge NL is considering investing in a new project. Given the following information, which project would Ridge choose if a maximum payback period of 5.8 years is set?

A) Project B, as the payback period is less than 5.8 years.

B) Both projects, as the payback periods are less than 5.8 years.

C) Project A, as the payback period is less than 5.8 years.

D) Neither project, as both payback periods exceed 5.8 years.

Correct Answer:

Verified

Q31: What is an advantage of the payback

Q32: A positive net present value indicates that:

A)

Q33: What is the internal rate of return

Q34: The payback period is:

A) the length of

Q35: Which of the following statements is true

Q37: Guerdon Ltd is reviewing a project that

Q38: The Orgonne Milling Company is contemplating the

Q39: Which of the methods of evaluating capital

Q40: Companies evaluating capital investment projects frequently use

Q41: A business is for sale at $100

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents