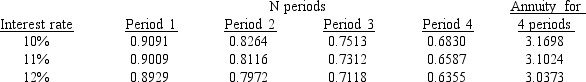

You have an opportunity to purchase the Kuppajo Cafe, a busy shop near your office. The owner is asking $49 000. After satisfying yourself as to the accuracy of the firm's past financial statements, you note that it generated $12 000 per year in net cash flow. You believe you could operate the business for four years and sell it for $30 000. What is the maximum amount you would be willing to pay for the business if you wished to earn at least a 10% return on your investment?

A) $33 467

B) $58 528

C) $68 690

D) $95 096

Correct Answer:

Verified

Q38: The Orgonne Milling Company is contemplating the

Q39: Which of the methods of evaluating capital

Q40: Companies evaluating capital investment projects frequently use

Q41: A business is for sale at $100

Q42: The Tearess Company can accept either Proposal

Q44: Describe the accounting rate of return (ARR)

Q45: Earning interest in one period on interest

Q46: Which of the following combinations of interest

Q47: If you placed $1000 in a savings

Q48: An annuity is a series of:

A) equal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents