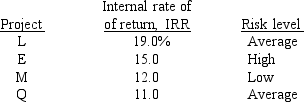

An evaluation of four independent capital budgeting projects by the director of capital budgeting for Ziker Golf Company yielded the following results:  The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

A) Project L

B) Projects L and E

C) Projects L and M

D) Projects L, E, and M

E) None of the above is a correct answer.

Correct Answer:

Verified

Q66: Stanton Inc.is considering the purchase of a

Q68: Hill Top Lumber Company is considering building

Q70: Given the following information, calculate the NPV

Q70: Cyrus Cypress evaluates all capital budgeting projects

Q72: Carolina Insurance Company, an all-equity life insurance

Q73: Which of the following items should not

Q74: If a firm uses its weighted average

Q76: When determining the marginal cash flows associated

Q78: The financial staff's role in the forecasting

Q80: How do most firms deal with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents