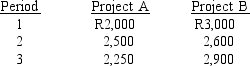

Real Time Systems Inc.is considering the development of one of two mutually exclusive new computer models.Each will require a net investment of R5,000.The cash flow figures for each project are shown below:  Model B, which will use a new type of laser disk drive, is considered a high-risk project, while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

Model B, which will use a new type of laser disk drive, is considered a high-risk project, while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

A) NPVA = R380; NPVB = R1,815.

B) NPVA = R197; NPVB = R1,590.

C) NPVA = R380; NPVB = R1,590.

D) NPVA = R5,380; NPVB = R6,590.

E) None of the above statements is correct.

Correct Answer:

Verified

Q64: Which of the following cash flows are

Q66: Dick Boe Enterprises, an all-equity firm, has

Q81: Whitney Crane Inc.has the following independent investment

Q82: Exhibit 10-1

You have been asked by the

Q83: Exhibit 10-1

You have been asked by the

Q85: Klott Company encounters significant uncertainty with

Q86: The Unlimited, a national retailing chain, is

Q87: Your company must ensure the safety of

Q88: Meals on Wings Inc.supplies prepared meals for

Q89: Mid-State Electric Company must clean up the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents