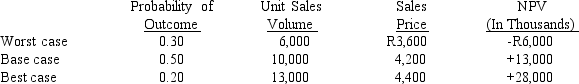

Klott Company encounters significant uncertainty with its sales volume and price in its primary product.The firm uses scenario analysis in order to determine an expected NPV, which it then uses in its budget.The base case, best case, and worst case scenarios and probabilities are provided in the table below.What is Klott's expected NPV, standard deviation of NPV, and coefficient of variation of NPV?

A) Expected NPV = R35,000; NPV = 17,500; CVNPV = 2.0.

B) Expected NPV = R35,000; NPV = 11,667; CVNPV = 0.33.

C) Expected NPV = R10,300; NPV = 12,083; CVNPV = 1.17.

D) Expected NPV = R13,900; NPV = 8,476; CVNPV = 0.61.

E) Expected NPV = R10,300; NPV = 13,900; CVNPV = 1.35.

Correct Answer:

Verified

Q64: Which of the following cash flows are

Q81: Whitney Crane Inc.has the following independent investment

Q82: Exhibit 10-1

You have been asked by the

Q83: Exhibit 10-1

You have been asked by the

Q84: Real Time Systems Inc.is considering the development

Q86: The Unlimited, a national retailing chain, is

Q87: Your company must ensure the safety of

Q88: Meals on Wings Inc.supplies prepared meals for

Q89: Mid-State Electric Company must clean up the

Q90: Tech Engineering Company is considering the purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents