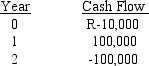

Two fellow financial analysts are evaluating a project with the following net cash flows:  One analyst says that the project has an IRR of between 12 and 13%.The other analyst calculates an IRR of just under 800%, but fears his calculator's battery is low and may have caused an error.You agree to settle the dispute by analysing the project cash flows.Which statement best describes the IRR for this project?

One analyst says that the project has an IRR of between 12 and 13%.The other analyst calculates an IRR of just under 800%, but fears his calculator's battery is low and may have caused an error.You agree to settle the dispute by analysing the project cash flows.Which statement best describes the IRR for this project?

A) There is a single IRR of approximately 12.7 percent.

B) This project has no IRR, because the NPV profile does not cross the X axis.

C) There are multiple IRRs of approximately 12.7 percent and 787 percent.

D) This project has two imaginary IRRs.

E) There are an infinite number of IRRs between 12.5 percent and 790 percent that can define the IRR for this project.

Correct Answer:

Verified

Q65: Two projects being considered by a firm

Q65: Which of the following is most correct?

Q66: Which of the following statements is correct?

A)One

Q69: The Coffee Corporation has been presented with

Q69: In comparing two mutually exclusive projects of

Q72: Which of the following statements is correct?

A)There

Q72: Two projects being considered are mutually exclusive

Q73: Project A has a cost of R1,000,

Q74: Two projects being considered are mutually exclusive

Q75: Project X has a cost of R30,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents