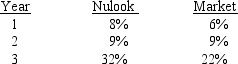

Below are the returns of Nulook Cosmetics and the "market" over a three-year period:  Nulook finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its required rate of return.Currently, the risk-free rate is 7 percent, and the estimated market risk premium is 6 percent.Nulook is evaluating a project which has a cost today of R2,028 and will provide estimated cash inflows of R1,000 at the end of the next 3 years.What is this project's MIRR?

Nulook finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its required rate of return.Currently, the risk-free rate is 7 percent, and the estimated market risk premium is 6 percent.Nulook is evaluating a project which has a cost today of R2,028 and will provide estimated cash inflows of R1,000 at the end of the next 3 years.What is this project's MIRR?

A) 12.4%

B) 16.0%

C) 17.5%

D) 20.0%

E) 22.9%

Correct Answer:

Verified

Q75: Project X has a cost of R30,000

Q77: Tuna Inc., a large tuna canning firm

Q78: Michigan Mattress Company is considering the purchase

Q79: An insurance firm agrees to pay you

Q79: Which of the following statements is correct?

A)The

Q81: Your company is considering two mutually exclusive

Q82: After getting her degree in marketing and

Q83: Your company is choosing between following non-repeatable,

Q84: A company is analysing two mutually exclusive

Q85: An investment project has an initial cost,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents