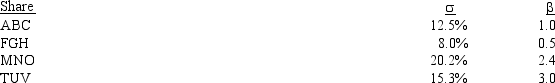

According to the following information, which of the shares would be considered riskiest in a diversified portfolio of investments?

A) Share MNO, because it has the highest standard deviation.

B) Share TUV, because it has the highest beta.

C) Share FGH, because it has the highest s/b ratio

D) Share ABC, because its beta is the same as the market beta (1.0) and the market is always very, very risky.

Correct Answer:

Verified

Q20: Which of the following statements is false?

A)

Q30: You have developed the following data on

Q31: In a portfolio of three different shares,

Q32: Share A has a beta of 1.5

Q33: All else equal, risk averse investors generally

Q35: Which of the following statements is most

Q37: Which of the following statements is correct?

A)

Q38: Which of the statements is most correct?

A)

Q39: According to the capital asset pricing model,

Q79: Other things held constant, (1) if the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents