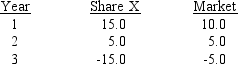

Share X and the "market" had the following returns during the last three years, and the same relative volatility is expected to exist in the future:  The riskless rate is rRF = 8%, and the expected return on the market is 12 percent.If equilibrium exists, what is the expected return on Share X?

The riskless rate is rRF = 8%, and the expected return on the market is 12 percent.If equilibrium exists, what is the expected return on Share X?

A) -4%

B) 8%

C) 12%

D) 14%

E) 16%

Correct Answer:

Verified

Q38: Which of the statements is most correct?

A)

Q39: According to the capital asset pricing model,

Q40: Which of the following statements is correct?

A)

Q42: If a share has a beta

Q44: Steve Brickson currently has an investment

Q45: Which of the following statements is most

Q46: Assume that a new law is passed

Q47: Given the following information, compute the coefficient

Q48: Given the following probability distributions, what are

Q53: is a measure of total risk, whereas

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents