CAPM Analysis

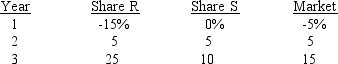

You have been asked to use a CAPM analysis to choose between shares R and S, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin.The risk-free rate is 6%, and the required return on an average share (or "the market") is 10%.Your security analyst tells you that Share S's expected rate of return is = 11%, while Share R's expected rate of return in = 13%.The CAPM is assumed to be a valid method for selecting shares, but the expected return for any given investor (such as you) can differ from the required rate of return for a given share.The following past rates of return are to be used to calculate the two shares' beta coefficients, which are then to be used to determine the shares' required rates of return.

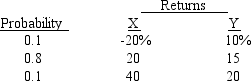

-Here are the expected returns on two shares:  If you form a 50-50 portfolio of the two shares, what is the portfolio's standard deviation?

If you form a 50-50 portfolio of the two shares, what is the portfolio's standard deviation?

A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

Correct Answer:

Verified

Q54: Oakdale Furniture Inc.has a beta coefficient of

Q57: Assume the risk-free rate of return

Q58: Share Q has a beta (

Q59: Share X has (

Q60: HR Corporation has a beta of 2.0,

Q61: CAPM Analysis

You have been asked to use

Q63: CAPM Analysis

You have been asked to use

Q64: You are managing a portfolio of 10

Q66: Company X has beta = 1.6, while

Q67: You hold a diversified portfolio consisting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents