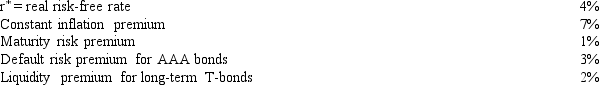

You are given the following data:  Assume that a highly liquid market does not exist for long-term T-bonds, and the expected rate of inflation is a constant.Given these conditions, the nominal risk-free rate for T-bills is __________, and the rate on long-term Treasury bonds is __________.

Assume that a highly liquid market does not exist for long-term T-bonds, and the expected rate of inflation is a constant.Given these conditions, the nominal risk-free rate for T-bills is __________, and the rate on long-term Treasury bonds is __________.

A) 4%; 14%

B) 4%; 15%

C) 11%; 14%

D) 11%; 15%

E) 11%; 17%

Correct Answer:

Verified

Q12: Interest rates on 1-year,2-year,and 3-year Treasury bills

Q14: Assume that the expectations theory holds,and that

Q26: Assume that the current interest rate on

Q32: Which of the following statements is correct?

A)

Q33: You read in The Financial Mail that

Q34: Treasury securities that mature in 6 years

Q35: Which of the following is not one

Q39: Carter Corporation has some money to invest,

Q40: If the South African Reserve Bank sells

Q42: In 2000, Craig and Kathy Khumalo owned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents