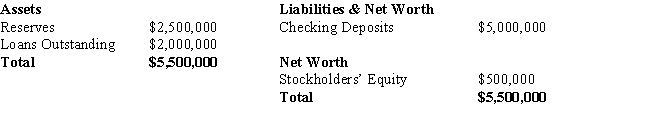

If the reserve ratio was 10 percent for the bank with the balance sheet listed below, then this bank is being

A) aggressive as indicated by a small amount of excess reserves.

B) aggressive as indicated by a large amount of excess reserves.

C) cautious as indicated by a small amount of excess reserves.

D) cautious as indicated by a large amount of excess reserves.

Correct Answer:

Verified

Q24: A bank would be considered insolvent when

Q25: The recession of 2007-2009 was the most

Q26: The central idea behind the Troubled Asset

Q27: If the buyer commits $100,000 of his

Q28: The increased level of excess reserves that

Q30: A bubble is best defined as a(n)

A)increase

Q31: The Fed's loan that effectively nationalized AIG

Q32: Excessive leverage can be traced to lax

Q33: Most economists feel that overly strict financial

Q34: When the housing bubble burst, prices fell

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents