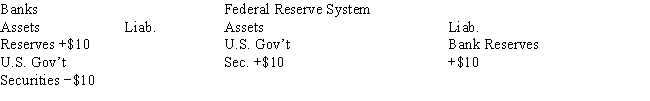

Table 29-1

Effects of an open-market transaction on the balance sheets of banks and the fed (in millions of dollars)

-After the transaction in Table 29-1 is completed, what happens to actual reserves, required reserves, and excess reserves? Assume the required reserve ratio is 25 percent.

A) Actual reserves increase by $10 million, required reserves increase $2.5 million, and excess reserves increase by $7.5 million.

B) Actual reserves decrease by $10 million, required reserves decrease $2.5 million, and excess reserves decrease by $7.5 million.

C) Actual reserves increase by $10 million, required reserves are unchanged, and excess reserves increase by $10 million.

D) Actual reserves decrease by $10 million, required reserves decrease by $10 million, and excess reserves are unchanged.

Correct Answer:

Verified

Q52: If the Fed buys a T-bill from

Q107: The Fed conducts an open-market purchase of

Q108: The Fed's purchase and sale of government

Q109: The Fed conducts an open-market sale of

Q110: The money supply contracts when the Fed

A)replaces

Q112: If the Fed sells a T-bill to

Q113: If the Federal Open Market Committee decides

Q114: The tool most frequently relied on by

Q115: Which of the following is the most

Q116: When the Fed purchases government securities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents