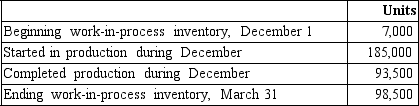

Titan Manufacturing uses a process cost system. The following information pertains to operations for the month of December.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs. The ending inventory was 85% complete for materials and 30% complete for conversion costs.

Costs pertaining to the month of December are as follows:

Beginning inventory costs are: materials, $38,200; conversion cost $41,400.

Costs incurred during December are: materials used, $462,300; conversion cost $602,700.

Required:

A. Using the weighted average method calculate the total equivalent units of production for direct materials and conversion cost.

B. Using the weighted average method, calculate the unit cost of materials and conversion for December.

C. Using the weighted average method, calculate the total cost of the units in the ending work-in-process inventory at December 31.

Correct Answer:

Verified

Q163: Describe how process costing for services differs

Q167: The Roberto Company had computed the flow

Q169: Davidson Company manufactures a product that passes

Q170: Explain how nonuniform inputs and multiple departments

Q170: AL Corporation produces a product that passes

Q171: Delilah, Incorporated, manufactures quality hair care products.

Q175: Explain the role of the departmental production

Q175: Mermain Inc., manufactures products that pass through

Q176: Indigo Inc., manufactures a product that passes

Q177: Plemmon Company adds materials at the beginning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents