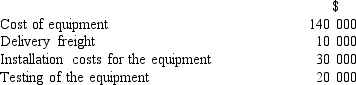

A company purchases equipment on 1 January 2019. The following costs are incurred:  The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

The equipment has an estimated life of five years and no salvage value. What is the depreciation expense in 2019 if the straight-line method is used?

A) $28 000

B) $36 000

C) $40 000

D) None of the above

Correct Answer:

Verified

Q4: Tanner Ltd purchased an item of equipment

Q5: Brown Ltd purchased a machine on the

Q6: When a company discards machinery that is

Q7: Which of the following should NOT be

Q8: A truck that cost $250 000 and

Q10: Equipment with a cost of $160 000

Q11: When the accumulated depreciation is deducted from

Q12: Jacques Ltd purchased a truck for $45

Q13: The purpose of depreciation is to:

A) allocate

Q14: On 1 January 2018, a new motor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents