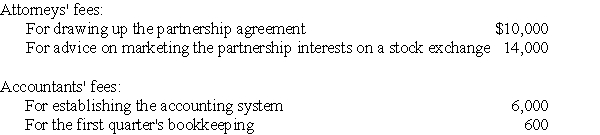

The RT Limited Partnership incurs the following expenses during the time that the partnership is being organized:  What is the maximum amount that the partnership can deduct as an organization and syndication expense for the first year in which the partnership begins business, assuming the business began on October 1?

What is the maximum amount that the partnership can deduct as an organization and syndication expense for the first year in which the partnership begins business, assuming the business began on October 1?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Bob contributes cash of $40,000 and Carol

Q27: Kay and Larry each contribute property to

Q28: Rashad contributes a machine having a basis

Q29: Stella acquired a 25% interest in the

Q30: Identify which of the following statements is

Q32: Sarah purchased land for investment in 2008

Q33: Allen contributed land, which was being held

Q34: For a 20% interest in partnership capital,

Q35: David contributes investment land with a basis

Q36: Ali, a contractor, builds an office building

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents