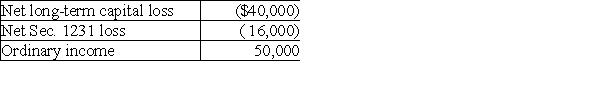

The XYZ Partnership reports the following operating results for the current year:  Tai has a 20% profits interest and a 25% loss interest in the XYZ Partnership. His distributive share of ordinary income is

Tai has a 20% profits interest and a 25% loss interest in the XYZ Partnership. His distributive share of ordinary income is

A) $6,800.

B) $8,500.

C) $10,000.

D) $12,500.

Correct Answer:

Verified

Q64: Meg and Abby are equal partners in

Q65: Mike and Jennifer form an equal partnership.

Q66: A partner's basis for his or her

Q67: At the formation of the BD Partnership,

Q68: Briefly explain the aggregate and entity theories

Q70: ABC Partnership distributes $12,000 to partner Al.

Q71: A partner's "distributive share" is the partner's

Q72: William and Irene each contributed $20,000 cash

Q73: Elijah contributes securities with a $90,000 FMV

Q74: What is included in partnership taxable income?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents