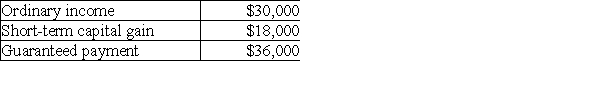

Brent is a limited partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Q106: In January of this year, Arkeva, a

Q107: Janice has a 30% interest in the

Q108: Yee manages Huang real estate, a partnership

Q109: Nicholas, a 40% partner in Nedeau Partnership,

Q110: Bud has devoted his life to his

Q111: Edward owns a 70% interest in the

Q113: If a partner takes a guaranteed payment,

Q114: In January, Daryl and Louis form a

Q115: Yee manages Huang real estate, a partnership

Q116: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents