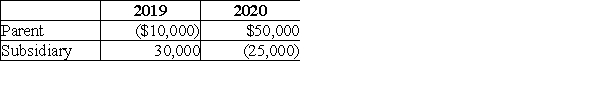

Parent and Subsidiary Corporations form an affiliated group. In 2019, the initial year of operation, Parent and Subsidiary filed separate returns. In 2020, the group files a consolidated tax return. The results for 2019 and 2020 are: Taxable Income  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

A) $0

B) $20,000

C) $25,000

D) none of the above

Correct Answer:

Verified

Q59: Identify which of the following statements is

Q60: Identify which of the following statements is

Q61: Parent and Subsidiary Corporations are members of

Q62: Pants and Skirt Corporations are affiliated and

Q63: A member's portion of a consolidated NOL

Q65: Mariano owns all of Alpha Corporation, which

Q66: A consolidated 2018 NOL carryover is $36,000

Q67: Boxcar Corporation and Sidecar Corporation, an affiliated

Q68: P and S comprise an affiliated group

Q69: Last year, Trix Corporation acquired 100% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents