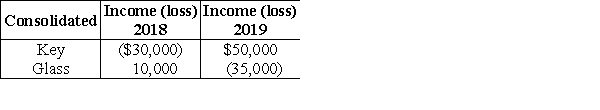

Key and Glass Corporations were organized in 2018. They became an affiliated group and filed separate tax returns. In 2019, the corporations begin filing a consolidated tax return. Key and Glass report the following results:  Which of the following statements is not correct?

Which of the following statements is not correct?

A) Key's last year NOL cannot offset Glass's last year profits.

B) Key's last year NOL cannot offset this year's consolidated taxable income.

C) Key's current year income must first be offset by Glass's current year loss.

D) All of the above are correct.

Correct Answer:

Verified

Q68: P and S comprise an affiliated group

Q69: Last year, Trix Corporation acquired 100% of

Q70: The Alto-Baxter affiliated group filed a consolidated

Q71: Identify which of the following statements is

Q72: Jason and Jon Corporations are members of

Q74: Parent and Subsidiary Corporations form an affiliated

Q75: What is the consequence of having losses

Q76: Blue and Gold Corporations are members of

Q77: Mako and Snufco Corporations are affiliated and

Q78: Jackson and Tanker Corporations are members of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents