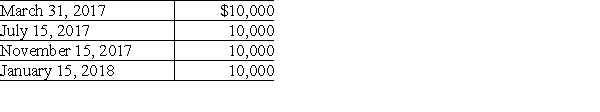

Sandy, a cash method of accounting taxpayer, has a basis of $46,000 in her 500 shares of Newt Corporation stock. She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31, 2017. What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31, 2017. What are the tax consequences of the distributions?

A) Sandy will recognize a loss of $4,500 in 2017 and a $1,500 loss in 2018.

B) Sandy will recognize the entire loss in 2017.

C) Sandy will recognize the entire loss in 2018.

D) None of the above is correct.

Correct Answer:

Verified

Q59: Market Corporation owns 100% of Subsidiary Corporation's

Q60: Ball Corporation owns 80% of Net Corporation's

Q61: Lake City Corporation owns all of the

Q62: Liquidating expenses are generally deducted as ordinary

Q63: The general rule for tax attributes of

Q65: Parent Corporation owns 100% of the stock

Q66: What attributes of a controlled subsidiary corporation

Q67: Identify which of the following statements is

Q68: Lake City Corporation owns all the stock

Q69: In a Sec. 332 liquidation, can a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents