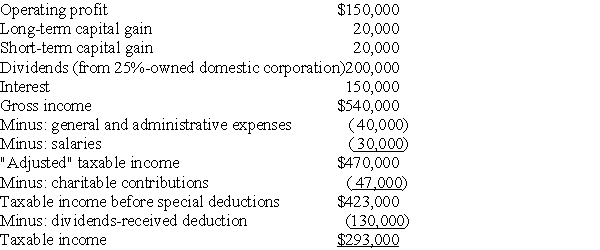

Mullins Corporation is classified as a PHC for the current year, reporting $263,000 of taxable income on its federal income tax return:  Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Khuns Corporation, a personal holding company, reports

Q32: Investors Corporation has ten unrelated individual shareholders

Q33: When using the Bardahl formula, an increase

Q34: Identify which of the following statements is

Q35: To avoid the accumulated earnings tax, a

Q37: All of the following are recognized as

Q38: Identify which of the following statements is

Q39: Eagle Corporation, a personal holding company, has

Q40: What is a personal holding company?

Q41: Which of the following is not permitted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents