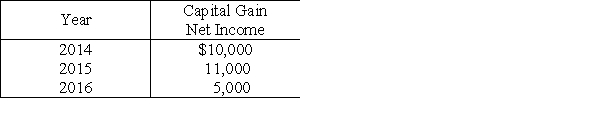

Evans Corporation has a $15,000 net capital loss in 2017. The corporation reported the following capital gain netting in income during the past three years. Identify which of the following statements is true.

A) The loss is used to offset the gains from 2016 and then carried back to offset $10,000 of the gains in 2014.

B) The loss is used to offset the $11,000 of the 2015 gains and then carried back to offset $4,000 of the year 2014 net gain.

C) The loss is used to offset $3,000 of 2014, 2015 and 2016 capital gains, remaining amount carried forward at $3,000 a year until expired.

D) The loss is used to offset the year 2014 net gains, then $5,000 of the year 2015 net gains.

Correct Answer:

Verified

Q16: Corporations are permitted to deduct $3,000 in

Q17: Corporations may deduct the adjusted basis of

Q18: The dividends-received deduction is designed to reduce

Q19: If a controlling shareholder sells depreciable property

Q20: Identify which of the following is false.

A)Corporations

Q22: Blueboy Inc. contributes inventory to a qualified

Q23: Identify which of the following statements is

Q24: Identify which of the following statements is

Q25: Identify which of the following statements is

Q26: Edison Corporation is organized on July 31.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents