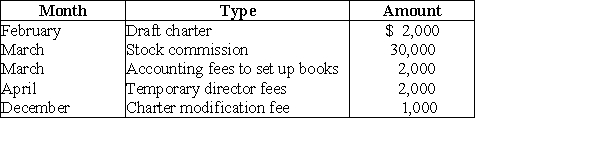

Green Corporation is incorporated on March 1 and begins business on June 1. Green's first tax year ends on October 31, i.e., a short year. Green incurs the following expenses during the year:  What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as possible?

What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as possible?

A) $36,000

B) $5,028

C) $667

D) $500

Correct Answer:

Verified

Q33: Identify which of the following statements is

Q34: Organizational expenditures include all of the following

Q35: Booth Corporation sells a building classified as

Q36: Super Corporation gives a painting to a

Q37: If a corporation's charitable contributions exceed the

Q39: In February of the current year, Brent

Q40: Maxwell Corporation reports the following results:

Q41: Miller Corporation has gross income of $100,000,

Q42: Chambers Corporation is a calendar year taxpayer

Q43: Lass Corporation reports a $25,000 net capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents