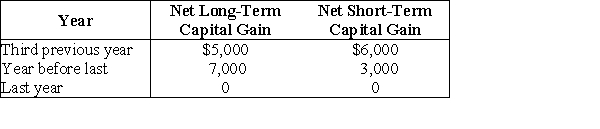

Lass Corporation reports a $25,000 net capital loss this year. The corporation reports the following net capital gains during the past three years.  Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Green Corporation is incorporated on March 1

Q39: In February of the current year, Brent

Q40: Maxwell Corporation reports the following results:

Q41: Miller Corporation has gross income of $100,000,

Q42: Chambers Corporation is a calendar year taxpayer

Q44: Access Corporation, a large manufacturer, has a

Q45: Ryan Corporation sells a commercial building and

Q46: Delux Corporation, a retail sales corporation, has

Q47: Walter, who owns all of the Ajax

Q48: Webster, who owns all the Bear Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents