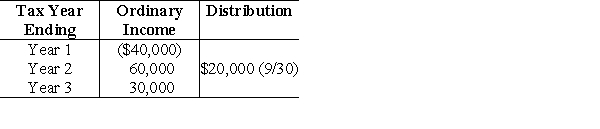

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation, an electing S corporation, when incorporated in January Year 1. Elkom's operating results and dividend distribution are as follows:  What is Elk's basis for his Elkom stock on December 31 of 2019?

What is Elk's basis for his Elkom stock on December 31 of 2019?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Eagle Corporation has always been an S

Q93: By electing to use the S corporation's

Q94: Identify which of the following statements is

Q95: An S corporation is not treated as

Q96: King Corporation, an electing S corporation, is

Q98: Identify which of the following statements is

Q99: David owns 25% of an S corporation's

Q100: Identify which of the following statements is

Q101: Which of the following tax levies imposed

Q102: Mashburn Corporation is an S corporation that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents