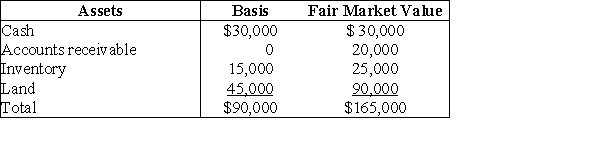

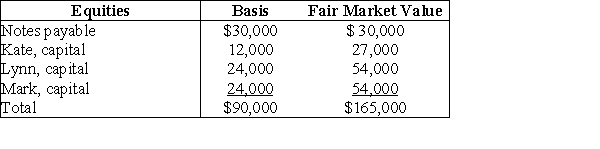

On December 31, Kate receives a $28,000 liquidating distribution from the KLM Partnership. On that date, Kate's basis in her limited partnership interest is $18,000 (which, of course, includes her share of partnership liabilities). The other partners assume her $6,000 share of liabilities. Just prior to the distribution, the partnership has the following balance sheet. Kate is leaving the partnership but the partnership is continuing.

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: The HMS Partnership, a cash method of

Q62: Tony sells his one-fourth interest in the

Q63: Tony sells his one-fourth interest in the

Q64: Joshua is a 40% partner in the

Q65: A partnership terminates for tax purposes

A)only when

Q67: What conditions are required for a partner

Q68: What is the character of the gain/loss

Q69: For tax purposes, a partner who receives

Q70: If a partnership chooses to form an

Q71: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents