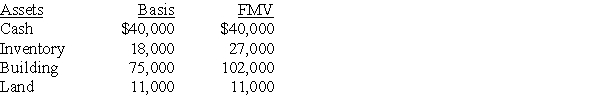

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000. On the date of sale, the partnership has no liabilities and the following assets:  The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: What is the character of the gain/loss

Q69: For tax purposes, a partner who receives

Q70: If a partnership chooses to form an

Q71: Identify which of the following statements is

Q72: Identify which of the following statements is

Q74: Eicho's interest in the DPQ Partnership is

Q75: When a retiring partner receives payments that

Q76: Under the check-the-box rules, an LLC with

Q77: If a partner dies, his or her

Q78: On December 31, Kate sells her 20%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents