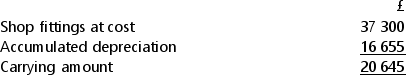

Darlene depreciates shop fittings on a reducing balance basis at 25% each year.At her 31 December 20X4 year end the balances included in non-current assets in respect of shop fittings were:  On 1 January 20X5, Darlene bought more shop fittings at a cost of £9650.She did not dispose of any shop fittings during the year.

On 1 January 20X5, Darlene bought more shop fittings at a cost of £9650.She did not dispose of any shop fittings during the year.

What was the depreciation charge in respect of Darlene's shop fittings in the year ended 31 December 20X5 (to the nearest £) ?

A) £6576

B) £7574

C) £11 737

D) £19 067

Correct Answer:

Verified

Q3: Bill buys new shelving for his warehouse

Q4: Ellie buys a new delivery vehicle on

Q5: Sohail runs a delivery business which charges

Q6: Cy employs a sales representative who uses

Q7: Ruby buys a non-current asset on 1

Q9: Which one of the following is not

Q10: Abbas runs a wholesale confectionery business.During 20X5

Q11: Grigor purchased a freehold building for use

Q12: On 1 January 20X4 Solway Pharma Limited

Q13: Which one of the following statements about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents