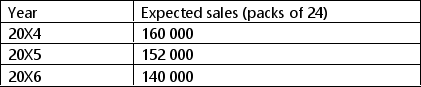

On 1 January 20X4 Solway Pharma Limited buys a licence to produce an anti-depressant.The licence runs for three years and costs £6 000 000.The directors decide to amortize the intangible asset in line with expected sales of the pills over the next three years.  What is the amount of amortization in respect of this licence to be charged to the company's statement of profit or loss in the 20X5 financial year (to the nearest £) ?

What is the amount of amortization in respect of this licence to be charged to the company's statement of profit or loss in the 20X5 financial year (to the nearest £) ?

A) £4 000 000

B) £4 141 593

C) £2 000 000

D) £2 017 699

Correct Answer:

Verified

Q7: Ruby buys a non-current asset on 1

Q8: Darlene depreciates shop fittings on a reducing

Q9: Which one of the following is not

Q10: Abbas runs a wholesale confectionery business.During 20X5

Q11: Grigor purchased a freehold building for use

Q13: Which one of the following statements about

Q14: Molly buys a new cash till on

Q15: Dagmar spent £11 700 on 1 February

Q16: Doris buys a non-current asset for £35

Q17: Gavin sold an item of machinery on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents