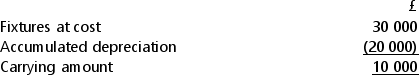

Daisy runs a small floristry business.She depreciates shop fixtures on the straight-line basis over four years, and assumes that the fixtures will have no value at the end of that period.The following balances were included in Daisy's statement of financial position in respect of shop fittings at 31 January 20X4:  On 1 February 20X1, when she started the business, she bought fixtures at a cost of £20 000.One year later, on 1 February 20X2, she spent a further £10 000.She charges 1/12th of the annual depreciation charge for each complete month of ownership.

On 1 February 20X1, when she started the business, she bought fixtures at a cost of £20 000.One year later, on 1 February 20X2, she spent a further £10 000.She charges 1/12th of the annual depreciation charge for each complete month of ownership.

On 1 August 20X4, Daisy disposed of all of her 20X1 purchase of shop fittings for £600.On the same day she bought replacement fittings for £25 000.

What is the total charge to Daisy's statement of profit or loss in respect of these transactions for the year ended 31 January 20X5?

A) £8125

B) £10 025

C) £7525

D) £13 150

Correct Answer:

Verified

Q17: Gavin sold an item of machinery on

Q18: Oscar's business invests in a new lorry

Q19: Norman runs a storage facility in which

Q20: Trish runs a boxing club.She installed a

Q21: Stan sells an item of machinery for

Q23: Which of the following statements about depreciation

Q24: Randolph started business on 1 January 20X1,

Q25: When a business charges depreciation on its

Q26: On 31 December 20X4 Oksana's statement of

Q27: Amie sells a motor vehicle for £6000.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents