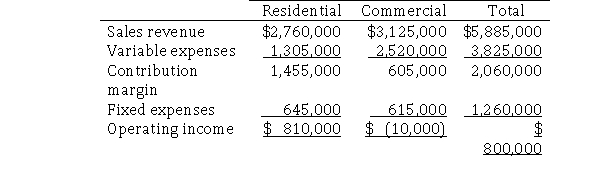

Bill Jones Flooring's accountant, has prepared the following income statement for the month of May.  In preparing the income statement, Bill was unsure what to do with $240,000 in corporate fixed expenses that cannot be traced to a division.Since these costs were incurred to run the business, and he believed that each division benefited equally, he just allocated half to each division.

In preparing the income statement, Bill was unsure what to do with $240,000 in corporate fixed expenses that cannot be traced to a division.Since these costs were incurred to run the business, and he believed that each division benefited equally, he just allocated half to each division.

Required:

a.How do you think Bill should have handled the $240,000 in corporate fixed expenses?

b.Prepare a segment margin income statement that highlights each division's contribution to corporate profits.Omit the heading.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q158: Lakeside Industries' operates as a decentralized organization.Its

Q159: Dublin Corporation has operating income of $15,000

Q160: Mounce Corporation produces and sells two products,

Q161: University Hospital provided the following segment margin

Q162: Major Corporation operates a wholesale electrical supply

Q164: Bethel Corporation provided the following income statement

Q165: The Assembly Division of Mounds Corporation makes

Q166: An organization may be structured as a

Q167: Nobles Corporation provided the following income statement

Q168: Bethlehem Corporation had $1,000,000 in sales which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents