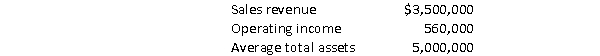

Tillamoke Company produces gourmet cheeses.Selected results from the most current year were as follows:  Production manager, Melinda Penland, is investing the purchase of a new fermenting station that will increase the plant's production capacity.Based on her research, Melinda thinks the station would cost $140,000 and would increase sales revenue by $200,000 and operating profit by $32,000.

Production manager, Melinda Penland, is investing the purchase of a new fermenting station that will increase the plant's production capacity.Based on her research, Melinda thinks the station would cost $140,000 and would increase sales revenue by $200,000 and operating profit by $32,000.

Required:

a.Calculate Tillamoke's current margin, asset turnover, and return on investment.

b.Calculate Tillamoke's margin, asset turnover, and return on investment assuming the company purchases the new fermenting station.

c.Assume Melinda Penland's annual bonus is based on the company's return on investment.Will Melinda support the purchase of the new fermenting station? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q173: Logan Corporation reported the following operating data

Q174: The Transformer division of Lorman Industries produces

Q175: In a decentralized organization, upper managers need

Q176: The Logan Company reported the following operating

Q177: Brooke Bundi, president of the Seco Corporation,

Q179: University Hospital provided the following income statement

Q180: Gooding Custom Design generated $320,000 in operating

Q181: Before a company makes the decision to

Q182: A disadvantage of evaluating managers' performance based

Q183: What is EVA and how is it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents