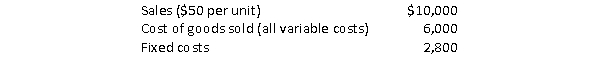

Use the information provided below to answer the following questions:  Required:

Required:

a.How many units would the company need to sell to earn $4,000 in operating income?

b.How many units would the company need to sell to earn $4,000 in net income if the tax rate is 20%?

c.By how much would operating income change from part (b) with a 10% increase in units sold?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q170: The New Age Pet Store sells Diva

Q171: Kid's Corner sells lamp systems for $25.These

Q172: Sabrina Industries has conducted market research which

Q173: Bart's Bike Shop has the following income

Q174: Marling Machine Works produces soft serve ice

Q176: Cindy's Chocolates sells its cream filled donuts

Q177: Colorado Furniture Company manufactures naturally weathered reclaimed

Q178: Bivouac Camping Supply sells harsh weather tents.The

Q179: Assume Wilkerson's Shoe Store has decided to

Q180: Patton Company's selling price is $100, variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents