Use the following information for questions

Desmond Corporation owns 3,000 of the 10,000 outstanding ordinary shares of Wetmore Corporation.During 2011, Wetmore earned £2,400,000 and paid cash dividends of £800,000.

-Greene Corporation sells 300 ordinary shares being held as an investment.The shares were acquired six months ago at a cost of $50 a share.Greene sold the shares for $40 a share.The entry to record the sale is

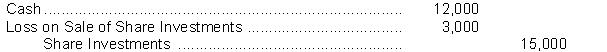

A)

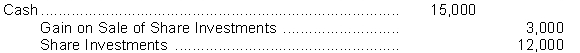

B)

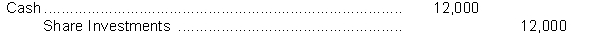

C)

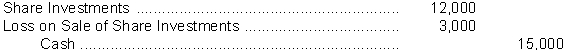

D)

Correct Answer:

Verified

Q62: Osaka Co.acquired a 10% interest in Chen

Q75: On January 1, Burkett Company purchased as

Q78: Use the following information for questions

Desmond

Q79: Use the following information for questions

Q79: Beneteau Corporation purchased 25,000 ordinary shares of

Q83: If an investor owns less than 20%

Q84: Jacobs Corporation makes a short-term investment

Q88: When a company holds shares of several

Q92: If a company acquires a 40% ordinary

Q99: When an investor owns between 20% and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents