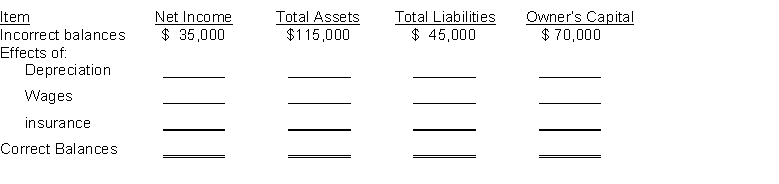

On December 31, 2022, Fashion Nugget Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $35,000. The balance sheet showed total assets, $115,000; total liabilities, $45,000; and owner's capital, $70,000.

The data for the three adjusting entries were:

(1) Depreciation of $10,000 was not recorded on equipment.

(2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded. The next payroll will (3) Insurance of $12,000 was paid for two months in advance on December 1. The entire amount was debited to Insurance Expense when paid.

Instructions

Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses):

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q149: The following ledger accounts are among those

Q150: The adjusted trial balance of the Chula

Q151: All of the accounts have normal balances.

Q152: Buena Vista Social Club accumulates the following

Q153: Prepare the required end-of-period adjusting entries for

Q155: Compute the net income for 2022

Q156: The trial balances before and after adjustments

Q157: Prepare the necessary adjusting entry for each

Q158: On Friday of each week, Knife Company

Q159: Gwynn Company has an accounting fiscal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents