The following information relates to Questions

anna lebedeva is a fixed-income portfolio manager. Paulina Kowalski, a junior analyst, and lebedeva meet to review several positions in lebedeva's portfolio.

lebedeva begins the meeting by discussing credit rating migration. Kowalski asks leb-edeva about the typical impact of credit rating migration on the expected return on a bond.

lebedeva asks Kowalski to estimate the expected return over the next year on a bond issued byentre corp. The bbb rated bond has a yield to maturity of 5.50% and a modified duration of 7.54. Kowalski calculates the expected return on the bond over the next year given the partial

credit transition and credit spread data in exhibit 1. She assumes that market spreads and yields will remain stable over the year. lebedeva next asks Kowalski to analyze a three-year bond, issued by Vrairive S.a., using an arbitrage-free framework. The bond's coupon rate is 5%, with interest paid annually and a par value of 100. in her analysis, she makes the following three assumptions:

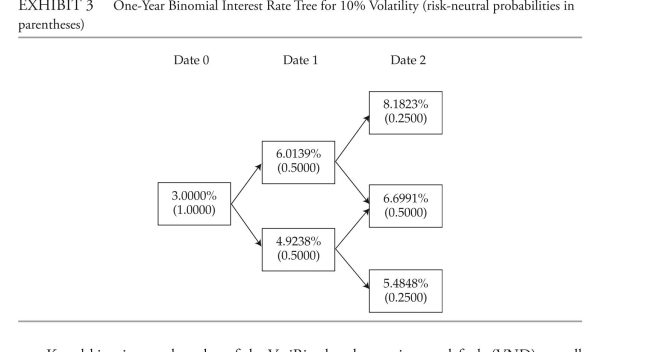

• The annual interest rate volatility is 10%.

• The recovery rate is one-third of the exposure each period.

• The hazard rate, or conditional probability of default each year, is 2.00%.

Selected information on benchmark government bonds for the Vrairive bond is presented

in exhibit 2, and the relevant binomial interest rate tree is presented in exhibit 3.  Kowalski estimates the value of the Vrairive bond assuming no default (Vnd) as wellas the fair value of the bond. She then estimates the bond's yield to maturity and the bond'scredit spread over the benchmark in exhibit 2. Kowalski asks lebedeva, "What might cause the bond's credit spread to decrease?"

Kowalski estimates the value of the Vrairive bond assuming no default (Vnd) as wellas the fair value of the bond. She then estimates the bond's yield to maturity and the bond'scredit spread over the benchmark in exhibit 2. Kowalski asks lebedeva, "What might cause the bond's credit spread to decrease?"

lebedeva and Kowalski next discuss the drivers of the term structure of credit spreads.Kowalski tells lebedeva:Statement 1: The credit term structure for the most highly rated securities tends to be either flat or slightly upward sloping.Statement 2: The credit term structure for lower-rated securities is often steeper, and creditspreads widen with expectations of strong economic growth.next, Kowalski analyzes the outstanding bonds of dll corporation, a high-quality issuerwith a strong, competitive position. her focus is to determine the rationale for a positively sloped credit spread term structure.lebedeva ends the meeting by asking Kowalski to recommend a credit analysis approach

for a securitized asset-backed security (abS) held in the portfolio. This non-static asset pool is made up of many medium-term auto loans that are homogeneous, and each loan is small relative to the total value of the pool.

-Which of Kowalski's statements regarding the term structure of credit spreads is correct?

A) only Statement 1

B) only Statement 2

C) both Statement 1 and Statement 2

Correct Answer:

Verified

Q1: The following information relates to Questions

Q2: The following information relates to Questions

Q3: The following information relates to Questions

Q4: The following information relates to Questions

Q6: The following information relates to Questions

Q7: The following information relates to Questions

Q8: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents