The following information relates to Questions 1-6

katrina black, portfolio manager at Coral bond Management, ltd., is conducting a training session with alex Sun, a junior analyst in the fixed income department. black wants to ex-plain to Sun the arbitrage-free valuation framework used by the firm. black presents Sun with exhibit 1, showing a fictitious bond being traded on three exchanges, and asks Sun to identify the arbitrage opportunity of the bond. Sun agrees to ignore transaction costs in his analysis.exhibit 1 Three-Year, €100 par, 3.00% Coupon, annual-Pay option-Free bond

black shows Sun some exhibits that were part of a recent presentation. exhibit 3 presents most of the data of a binomial lognormal interest rate tree fit to the yield curve shown in ex-hibit 2. exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual-pay bond with a 2.5% coupon based on the information in exhibit 3.exhibit 2 Yield to Maturity Par rates for one-, two-, and Three-Year annual-Pay option-Free bonds

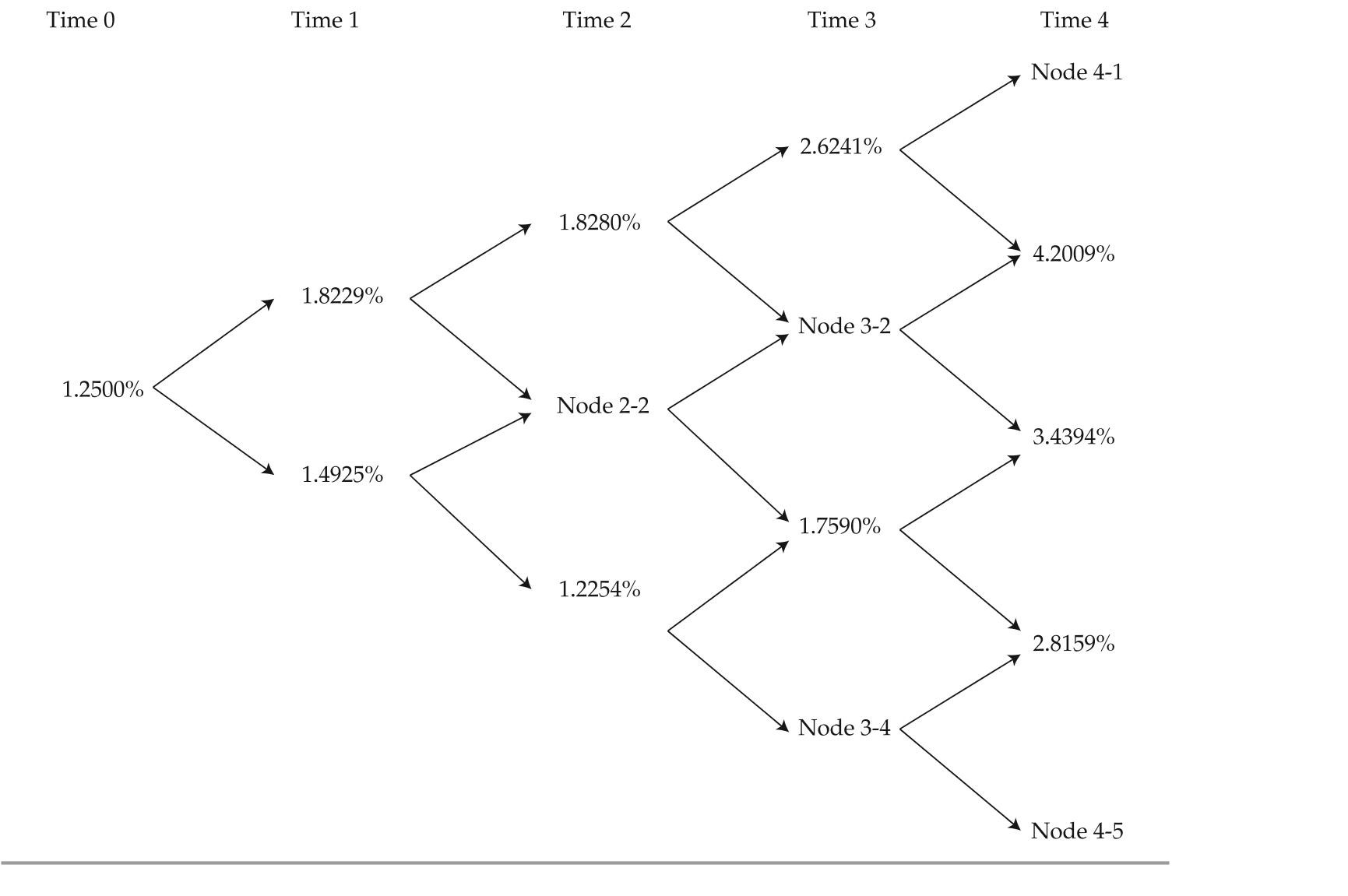

exhibit 3 binomial interest rate tree Fit to the Yield Curve (Volatility = 10%)

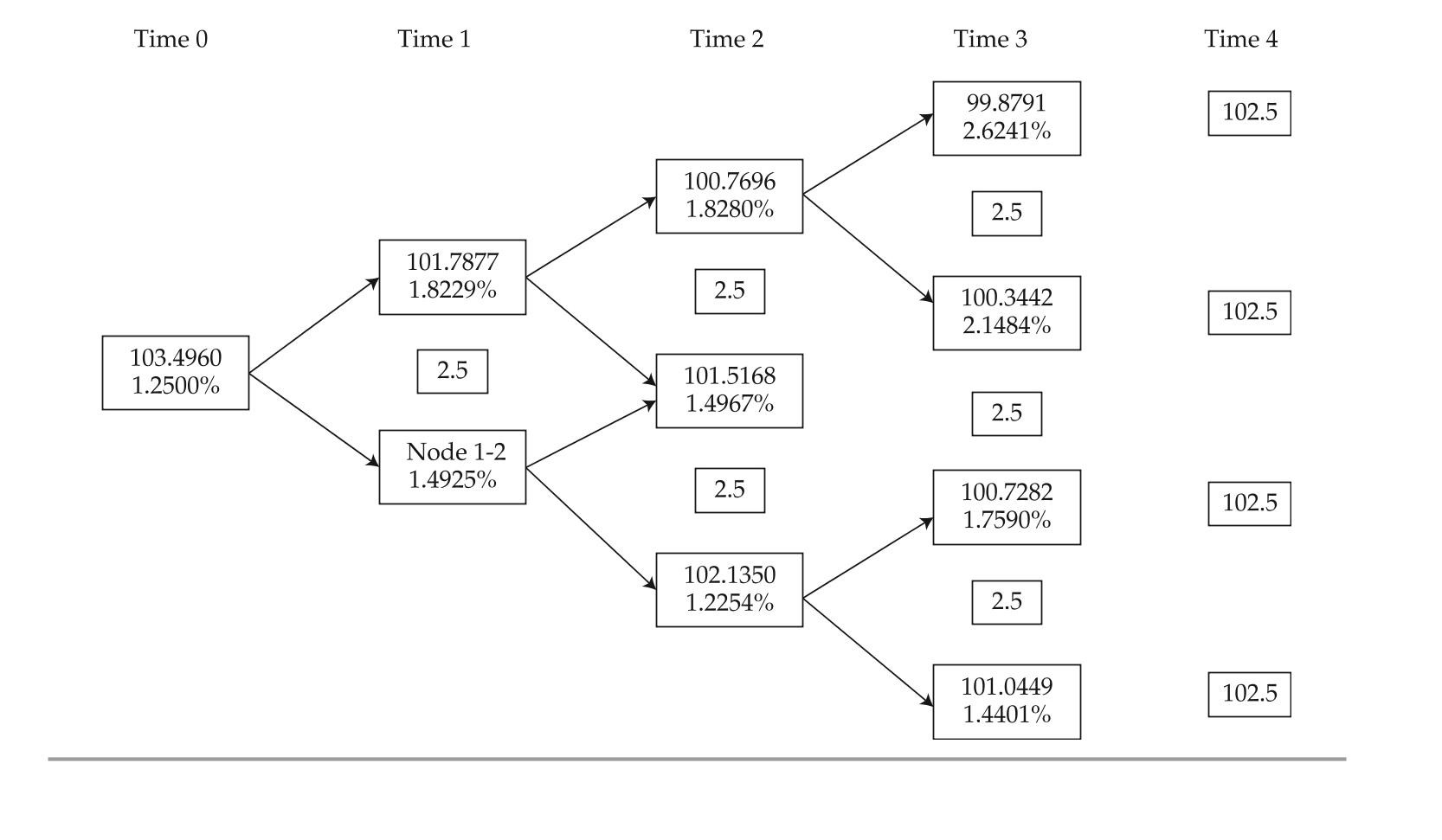

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

exhibit 4 implied Values (in euros) for a 2.5%, Four-Year, option-Free, annual-Pay bond based on exhibit 3

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

black asks about the missing data in exhibits 3 and 4 and directs Sun to complete the following tasks related to those exhibits:

task 1 test that the binomial interest tree has been properly calibrated to be arbitrage-free.

task 2 Develop a spreadsheet model to calculate pathwise valuations. to test the ac-curacy of the spreadsheet, use the data in exhibit 3 and calculate the value of the bond if it takes a path of lowest rates in Year 1 and Year 2 and the second lowest rate in Year 3.

task 3 identify a type of bond where the Monte Carlo calibration method should be used in place of the binomial interest rate method.

task 4 update exhibit 3 to reflect the current volatility, which is now 15%.

-which of the following statements about the missing data in exhibit 3 is correct?

A) node 3-2 can be derived from node 2-2.

B) node 4-1 should be equal to node 4-5 multiplied by

C) node 2-2 approximates the implied one-year forward rate two years from now.

Correct Answer:

Verified

Q7: The following information relates to Questions

Q8: The following information relates to Questions

Q9: The following information relates to Questions

Q10: The following information relates to Questions

Q11: The following information relates to Questions

Q12: The following information relates to Questions

Q13: The following information relates to Questions

Q14: The following information relates to Questions

Q16: The following information relates to Questions

Q17: The following information relates to Questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents